The cadastral appraisal

What is the Cadastral Assessment?

As I mentioned before, the appraisal can be considered A transaction to the object more than a fact, which seeks to find a market reference value known as cadastral value. A property may have several appraisals, with different methodologies and dates. It is generally below the commercial value (close to 80%), not only because it comes from a massive study but because some factors that influence the final market value are not generally considered, such as the extra cost for professional services, advertising costs or administrative costs of the development company.

In the case of Uruguay, to give an example: The cadastral value can never exceed 80% of the commercial value

Its utility

The most frequent use is for the application in the collection of real estate tax or property tax. The purpose of the appraisal is to apply a contribution law with social equity, assuming that the tax is distributed according to the value of the property (whoever has more pays more). It also has applicability for commercial transactions, which varies between countries according to the legislation, but a cadastral record is frequent for the purposes of a bank loan, financial support in the application for a North American visa, expropriation and compensation processes, recovery studies of capital gain, etc.

Your application

The laws of each country change in the application of this tax, such as El Salvador, where it does not exist under that denomination, and in the case of Colombia where this tax includes:

-

The park or arborization tax

-

Socioeconomic stratification tax

-

Cadastral Survey Surcharge

There are also different forms of application, some under municipal autonomy, as is the case in Honduras and others under centralized control, such as in Spain, where the Ministry of Finance does the study of values by zones, but the municipalities make the presentations for the agreement of local rates. Generally, the concept of Property is based on the definitions in the civil code, where it is established as property that which cannot be dismantled from the plot without affecting its basic structure, therefore it includes both the building, other improvements and even crops that in the medium and long term they are permanent increasing their value for reasons of productivity.

Generally, the rates are between 1 and 15% of every thousand, which means that a property valued at $ 200,000 if the rate were 4% would have to pay $ 400 per year. It does not seem to be much, but it is usually the second in weight, when we remember that there are other types of direct taxes such as:

-

Industry and Commerce

-

Gasoline surcharge

-

Street lighting

-

Signs

-

Environmental surcharge

-

Delineation and urban planning

-

Toilet train, fire service and other services

The urban appraisal

In general terms, the urban appraisal, using the (there are others) method of replacement cost minus accumulated depreciation has two components:

In general terms, the urban appraisal, using the (there are others) method of replacement cost minus accumulated depreciation has two components:

The value of the land. This normally starts from a study based on market transactions, which if done in a representative way can be translated into homogeneous areas where approximate values of the land can be obtained.

In addition, there are factors that individually influence specific properties, either negatively or positively:

- The corner condition

- The topography, when it affects the risk of landslide, flood or increase the cost of construction

- The special regime

- Vulnerability to landslides or floods

- The front-to-bottom relationship

- The landscape value

- Existing public services

With this you get The value of the land

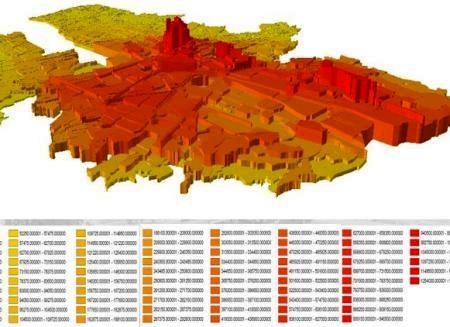

In the case of Medellín, the following are considered values that affect the value of the land: topography, land use, roads and public services. And these areas are called homogeneous geoeconomic zones, and regression tables, in another post we will show the complete process of Medellín.

In the case of Medellín, the following are considered values that affect the value of the land: topography, land use, roads and public services. And these areas are called homogeneous geoeconomic zones, and regression tables, in another post we will show the complete process of Medellín.

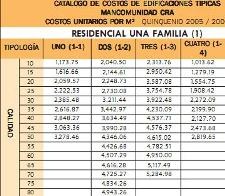

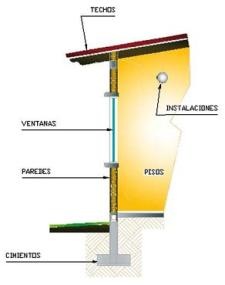

The value of the buildingThis is applied from studies of construction typologies, which are based on the weighting of typical buildings, which in turn were calculated by means of unit cost sheets. Then the capture process classifies the constructive elements that influence the value; thus having: the use for which the building was built, the class of materials and the quality of workmanship or sum of weights of construction elements, it can be defined to which construction type it corresponds.

The value of the buildingThis is applied from studies of construction typologies, which are based on the weighting of typical buildings, which in turn were calculated by means of unit cost sheets. Then the capture process classifies the constructive elements that influence the value; thus having: the use for which the building was built, the class of materials and the quality of workmanship or sum of weights of construction elements, it can be defined to which construction type it corresponds.

Once identified the constructive typology that applies, is multiplied by the total of square meters, if there is more than one first plant is applied a modification factor and the sum generated The value of the building.

Additionally, the accumulated depreciation factor is applied, for which a table is also used that is based on the years of construction of the building and restoration it has received. For special buildings, appraisals are made using other types of methods, such as in the case of tourist complexes, technology-oriented industrial zones, airports, etc. Other additional details are calculated separately, although they are also within the study of buildings.

Additionally, the accumulated depreciation factor is applied, for which a table is also used that is based on the years of construction of the building and restoration it has received. For special buildings, appraisals are made using other types of methods, such as in the case of tourist complexes, technology-oriented industrial zones, airports, etc. Other additional details are calculated separately, although they are also within the study of buildings.

Thus the urban appraisal consists of the sum of:

-

The value of the land

-

The value of the building

-

The value of other additional details

Rural appraisal

The rural or rustic value is similar to urban, having the following components:

The value of land, for studies of land value there are special methods based on the relationship of the market value and its productivity within a given economic and climatic area. This classification includes physical, topographic, climatic, geographical and basic access factors for production purposes.

The value of land, for studies of land value there are special methods based on the relationship of the market value and its productivity within a given economic and climatic area. This classification includes physical, topographic, climatic, geographical and basic access factors for production purposes.

So a classification of soils is made based on their agrological capacity, which also becomes a homogeneous area. The value will be determined by the value of the square meter of the area, by the area of the plot; This, unlike the urban one, has modification factors that influence its value such as:

-

Distance to commercial nodes

-

Access to roads

-

Distance to water source or irrigation system

-

Topography

Once applied, you will get The value of rural land

Also the value of rural land includes Value of buildings, the construction typology studies can include typical constructions of rural areas such as wineries, farms, galleys, etc. There will also be additional details that will be calculated separately, as in the urban, such as swimming pools, porches, walls, veneers, pavements, stairs, etc.

The value of Permanent crops, For this, usually the study based on costs of input, labor and mechanization concludes in an average for different plants (coffee, cocoa, African palm, etc.)

The value of Permanent crops, For this, usually the study based on costs of input, labor and mechanization concludes in an average for different plants (coffee, cocoa, African palm, etc.)

Or in case of pasture per square meter. And these will have modification factors related to the expectation of productivity that is still expected of this crop, which include:

-

Phytosanitary status

-

Age of plants

Then, the product of the total of plants, by the cost of cultivation and multiplied by their factors of modification will be The value of permanent crops.

Then the rural appraisal will consist of the sum of:

- The value of the land

- The value of buildings or improvements

- The value of other additional details

- The value of permanent crops

Worth it?

It is possible that some of you, midway through the post felt like they were singing the capon cock game, before Melquiades came to cure the insomnia sickness in Macondo.

But it's worth it, at least if it will be for property tax purposes. In the case of Colombia, as a consequence, by putting into effect the three phases of the Cadastral Update in Medellín, whose total investment amounted to about 8,840 million pesos, the additional collection that can be attributed to the project for the concept of Unified Property Tax , in the first 3 years of validity, is equivalent to about fifteen times the value invested. In the case of Honduras, property tax is considered one of the potential of municipal self sustainability, although time has shown that the implementation of this process is easier than its sustainability by discontinuity.

To the extent that a governing institution of the fiscal or cadastral area implements, systematizes and gives continuity to a methodology, the valuation can be a very effective exercise; useful not only for tax matters. The cost of individual initiatives or hybrid methodologies may be higher than expected revenue.

It also affects poor policies in municipal labor competition, when political clientelism makes it necessary to be Training people Every time there is a change of government.

In this article there is a Manual for applying the urban appraisal method

I would like to know more about the problems of the cadastre

Not for me sounds bad the land tax in rural areas does not sound so fair to me because we who live in the villages are not receiving any help from the government nor much less take us into account with our needs so we do not have to Pay tax on this appraisal of land. We are Coban people and the municipality of our region does not listen to us when we need them.

Very interesting synthesis, soon there will be more searchers on that subject, I am sure

Excellent information on your page, I fell like a ring finger since at this time I needed to know something more about rural, urban assessment and how the land assesses in this ....

Thank you for that information. I hope to continue to publish much more of these subjects.

They are interesting the subjects of the cadastral assessments, give an academic approach with a well understood language. Congratulations on the portal.

Thank you for your information, very interesting but I am looking for something more specific and is if there is a link where you can find the value of the square meter of the land in barrancabermeja specifically in the Danube district.

Thank you for your cooperation